Simulating Financial Markets and Creating AI-Powered Strategies

Project Overview

This project focuses on designing and implementing AI-powered trading strategies to predict stock price movements, particularly for SPY (the S&P 500 ETF). Using historical data, we develop and test machine learning models to simulate real-market conditions and evaluate their effectiveness. Our approach includes backtesting, hyperparameter optimisation, and leveraging deep learning techniques to refine trading strategies. Python, TensorFlow, stock market APIs, and Jupyter Notebook are key technologies used for data analysis and modelling. By combining financial market insights with advanced AI techniques, this project aims to enhance algorithmic trading efficiency and profitability.

Challenge

Designing trading strategies that consistently outperform the market, handling noisy financial data, and overcoming computational constraints in backtesting and hyperoptimisation.

Solution

Utilising machine learning and deep learning models to analyse market patterns, optimise strategy parameters, and simulate market conditions for robust decision-making.

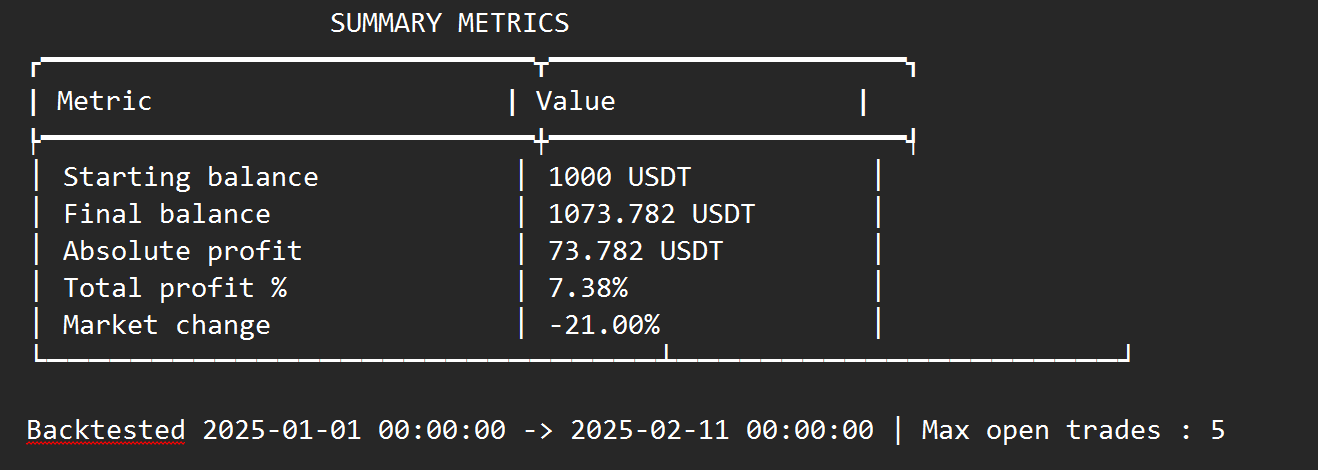

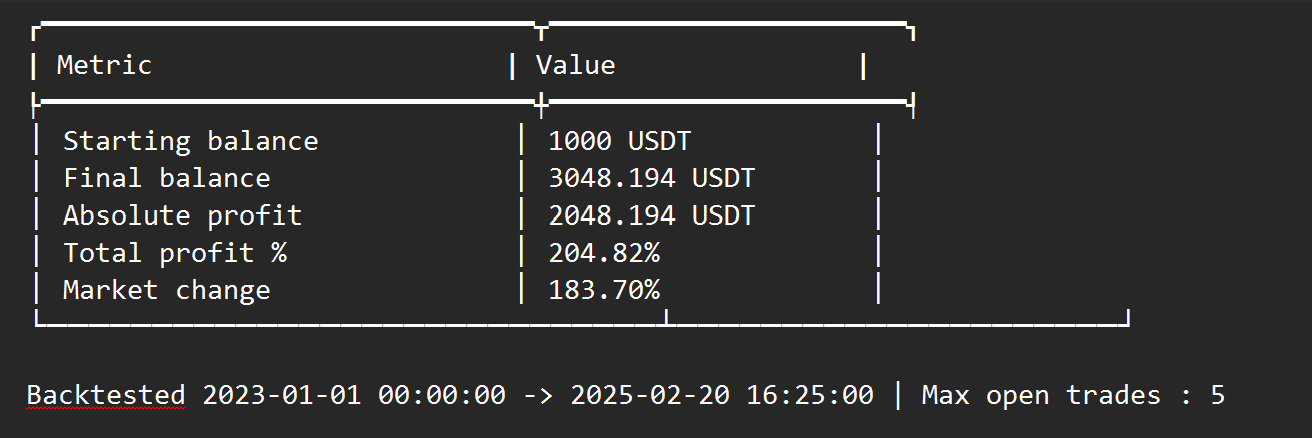

Results & Impact

Initial tests show promising results, with AI-driven strategies outperforming certain market conditions. However, challenges remain in ensuring consistency over long-term backtests. Future work focuses on refining models, expanding datasets, and improving computational efficiency for better real-world applicability.

Links

Project Gallery

Visual documentation of the project's key features and implementation.